Confidence that UK equities having "made up lost ground" post-Brexit is misplaced.

The largest UK companies that make up the bulk of the FTSE 100 and the MSCI UK Index have high exposure to global earnings.

Apparent "strength" in the largest UK equities is just a translation effect of that revenue exposure.

So the apparent uptick in UK equities offers no real comfort for global USD-based investors.

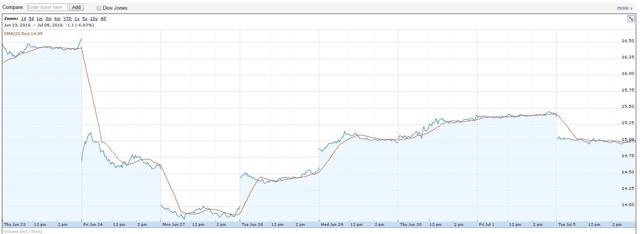

For GBP-denominated ETFs tracking MSCI UK Equity (e.g. LSE:CSUK) performance is +3.7% since the EU Referendum Day 23rd June 2016 before votes were counted. Over the same period, the USD version of the same ETF (e.g. NYSEARCA:EWU) performance is -9.3% while sterling has weakened -12.4% (FXB).

Performance of MSCI UK (LSE:CSUK) in GBP since EU Referendum

Performance of MSCI UK (EWU) in USD since EU Referendum

Chart Source: Google Finance

Comments

Post a Comment